what does mortgage life insurance cover

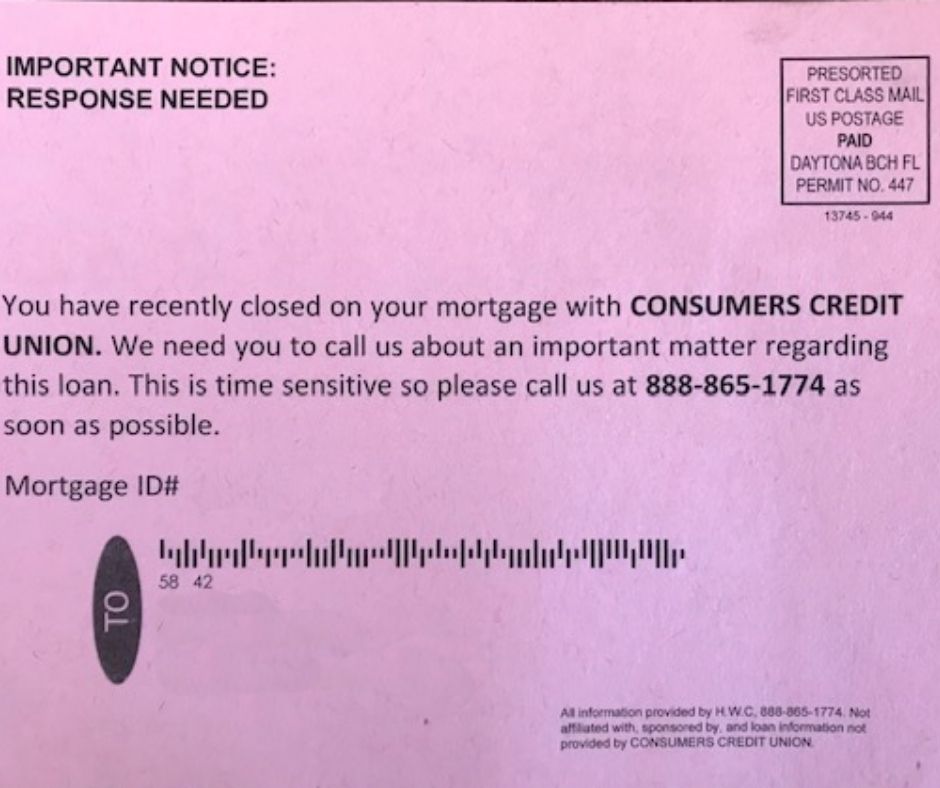

Several insurance firms are included in the list of companies informing you that you must safeguard your mortgage by acquiring the "mortgage assurance" policy. Homeowners often plea to assist their family members in staying at home in case they die suddenly.

Some independent life insurance agencies use this "life event" to offer life insurance. They are not trying to mislead you into thinking they are affiliated with your lender but want you to make them aware of their products or services.